The Ultimate Guide to Window Renovation Grants in Spain (2026 Edition): How to Save Up to €3,000

· María Fernández · Energy efficiency and savings · 7 min read

2026 marks the final year of the NextGenerationEU funding programme — and while the money is still available, the clock is ticking. If you’ve been putting off that window replacement project, there has never been a better time to act.

Many expats and property owners across Spain have heard rumours about “free money” for home renovations but feel overwhelmed by the prospect of Spanish bureaucracy. The paperwork, the technical requirements, the endless forms — it’s enough to make anyone postpone the project indefinitely.

Here’s the good news: in this comprehensive guide, we’ll walk you through exactly how to recover up to 80% of your window replacement costs through a combination of direct grants and tax deductions. And yes — at Ventanas Fraktal, we help our clients navigate the entire documentation process.

The “Double Benefit”: Direct Subsidy + Tax Deduction

What many property owners don’t realise is that financial assistance for energy-efficient window replacement comes from two separate sources — and you can claim both.

1. Direct Grant (Programa 4 – Ayudas para mejora de la eficiencia energética)

Under Spain’s Recovery, Transformation and Resilience Plan (PRTR), funded by NextGenerationEU, homeowners can receive:

- Up to 40% of the renovation cost as a direct subsidy

- Maximum grant: €3,000 per dwelling

- Minimum investment required: €1,000

The property must be your primary and permanent residence (vivienda habitual y permanente). Applications are processed through your local autonomous community or town hall (Ayuntamiento).

2. IRPF Tax Deduction (Declaración de la Renta)

In addition to the direct grant, the Spanish government has extended energy efficiency tax deductions through the end of 2026. These deductions are claimed on your annual income tax return:

- 20% deduction (max €5,000 base): For works reducing heating/cooling demand by at least 7%

- 40% deduction (max €7,500 base): For works reducing non-renewable primary energy consumption by 30% or achieving energy class A or B

- 60% deduction (max €15,000 base per unit): For community-wide building rehabilitation projects

Important: If your annual deduction exceeds these limits, you can carry forward the excess over the following four tax years.

A Real-World Example

Let’s say you’re replacing the windows in your apartment in Alicante. Here’s how the numbers might work:

| Item | Amount |

|---|---|

| Total cost of new windows | €4,000 |

| Direct grant (40%) | −€1,600 |

| IRPF Tax Deduction (40% of €2,400) | −€960 |

| Your final cost | €1,440 |

You save €2,560 — that’s 64% off the original cost!

Technical Requirements: Do Your Windows Qualify?

Not every window replacement qualifies for subsidies. The Spanish authorities have set specific energy performance criteria that must be met and verified by certified engineers.

Energy Reduction Targets

Your renovation must achieve at least one of the following:

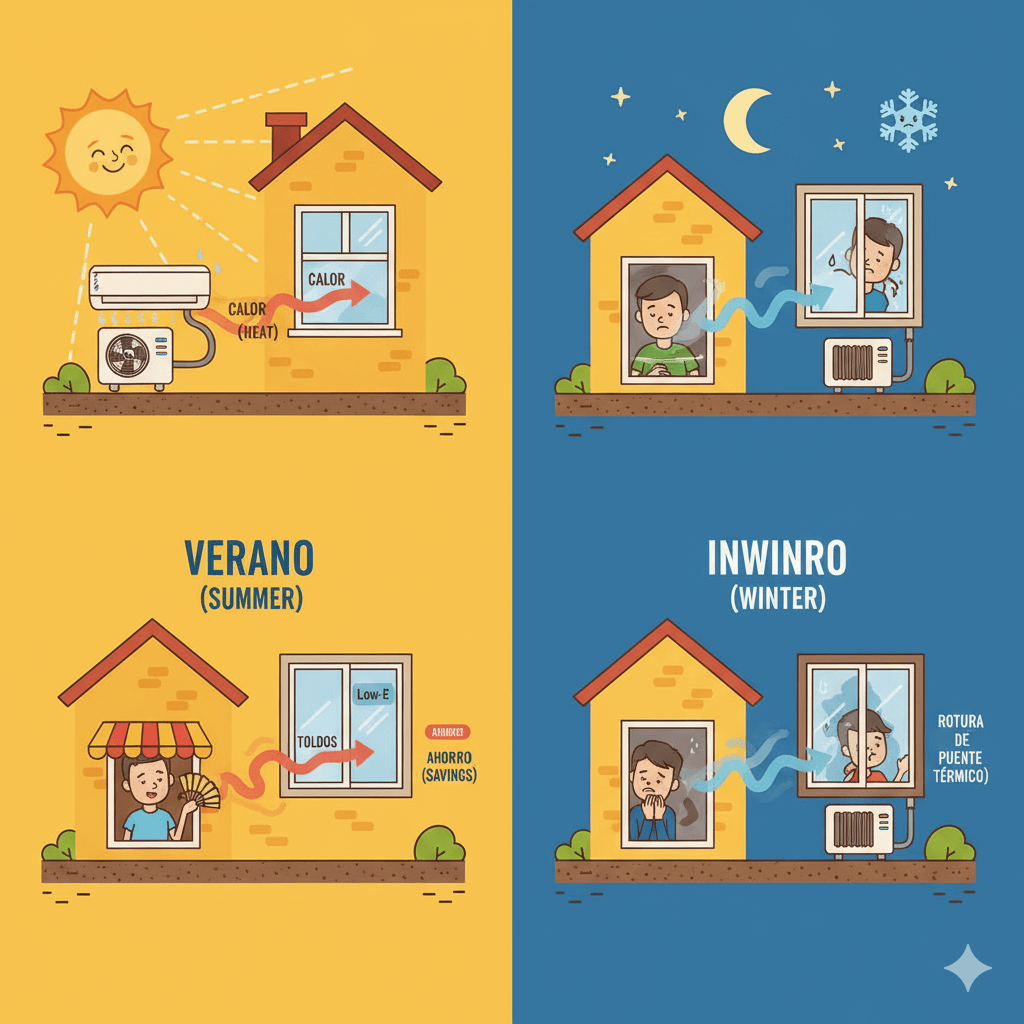

- A minimum 7% reduction in overall heating and cooling demand, OR

- A minimum 30% reduction in non-renewable primary energy consumption

Window Performance Standards

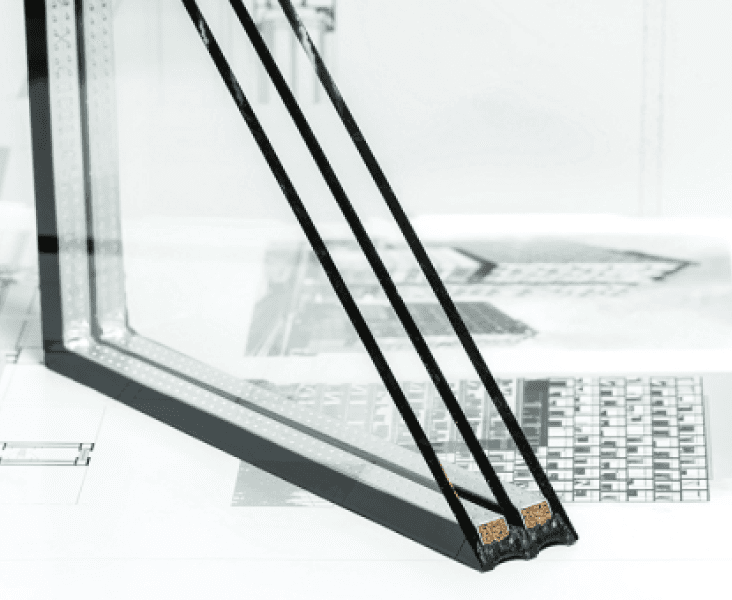

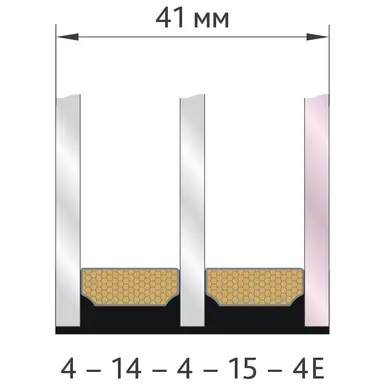

Spain’s Technical Building Code (CTE) sets maximum thermal transmittance values (Uw) based on climate zones. However, to qualify for subsidies and achieve meaningful energy savings, we recommend windows with:

- Uw ≤ 1.1 W/m²K — this is the gold standard for subsidy eligibility across all climate zones

- Air permeability class 2 minimum (class 3 for buildings over 15 metres)

- Sound insulation of 30+ dB for street-facing windows

Our recommendation: Premium profiles like REHAU Geneo (Uw from 0.79) and WDS 8S (Uw from 0.89) are guaranteed to exceed these standards — often by a significant margin. For properties in Asturias and other northern regions, these high-performance profiles provide excellent protection against both cold winters and summer heat.

Required Documentation

- Energy Performance Certificate (CEE) BEFORE installation — this establishes your baseline energy rating

- Energy Performance Certificate (CEE) AFTER installation — must be issued before 1 January 2027 to claim 2026 deductions

- Detailed invoice (Factura) — must include specific technical information (window specifications, U-values, project description)

- Bank proof of payment — cash payments do not qualify! You must pay by bank transfer, card, or direct deposit

- Declaration of Performance (DoP) and CE marking for all window products

- NIE/DNI and property documentation (Nota Simple or rental contract)

How Ventanas Fraktal Makes It Easy

We understand that documentation can be the biggest barrier to claiming your entitled subsidies. That’s why we provide:

- Complete technical documentation package — every installation includes DoP certificates, CE labels, and detailed technical specifications in the format required by Spanish authorities

- Coordination with certified energy engineers — we work with qualified technicians who can prepare your before-and-after energy certificates

- Subsidy-compliant invoicing — our invoices include all required technical wording and specifications

- Guidance in English — our team can explain the process in plain English and help you understand each step

Why 2026 is the Critical Deadline

The NextGenerationEU programme was designed as a temporary recovery measure following the pandemic. Spain received approximately €70 billion in grants, with a significant portion earmarked for energy efficiency improvements in residential buildings.

Here’s why timing matters:

- Programme deadline: 31 December 2026 — all funds must be committed by this date

- IRPF deductions expire — the current tax incentives are not guaranteed to continue beyond 2026

- Regional budgets are being exhausted — many autonomous communities have already seen high uptake; some may run out of funds before year-end

- Processing times — between energy certificates, installation, and paperwork, the full process can take 2-4 months

Our advice: Don’t wait until autumn. Start the process in Q1 or Q2 of 2026 to ensure you have time to complete all requirements before the deadline.

Regional Considerations Across Spain

While the national framework applies everywhere, each autonomous community administers its own subsidy programme with varying deadlines and requirements:

- Valencia and Alicante: Mediterranean climate zone B4. Focus on solar control (g-value ≤ 0.50 for south-facing windows) alongside thermal performance.

- Asturias: Cooler climate zone C1. Higher thermal requirements; premium triple-glazed profiles often recommended.

- Madrid: Zone D3. Additional noise insulation requirements (32+ dB) within the M-30 ring road.

- Catalonia: From 2024, new buildings require energy class A windows (Uw ≤ 1.4). Stricter standards expected for renovations.

- Balearic Islands: Special historic centre restrictions in Palma. Traditional shutter requirements in tourist zones.

Ready to Get Started?

Replacing your windows is an investment that pays dividends for decades: lower energy bills, improved comfort year-round, reduced noise, and increased property value. With subsidies and tax deductions covering up to 64% of your costs in 2026, there’s simply no better time to act.

At Ventanas Fraktal, we’re official partners of REHAU, VEKA, Cortizo, Kömmerling, Schüco, and WDS — offering energy-efficient PVC and aluminium window solutions across all of Spain. Our installation teams follow EU mounting standards, and every project comes with comprehensive documentation for your subsidy application.

Take the first step:

Request a free measurement and quote. We’ll help you understand your options, calculate potential savings, and guide you through the subsidy process from start to finish.

Ventanas Fraktal — Energy-efficient windows and doors across Spain. Alicante | Valencia | Madrid | Barcelona | Asturias | Balearic Islands and 52 more regions.

Published: January 2026 | Updated with latest IRPF deduction extensions and NextGenerationEU programme information.